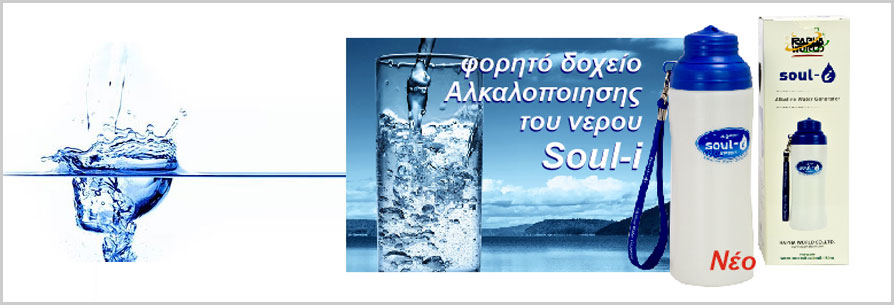

Τι είναι το φορητό δοχείο Αλκαλοποίησης Soul-i

Τώρα απολαύστε καθαρό νερό με το νέο ΦΟΡΗΤΌ δοχείο νερού Soul-i που μετατρέπει το χλωριωμένο νερό σε καθαρό πόσιμο νερό.

Το Soul-i είναι φτιαγμένο από φυτικές πρώτες ύλες που ρυθμίζουν το pH του νερού κάνοντας το αλκαλικό και συμβατό με το σώμα μας.Γεμίστε απλά το δοχείο με νερό από τη βρύση και μετά από 10 λεπτά μπορείτε να απολαύσετε εύγευστο, δροσερό και κυρίως ΚΑΘΑΡΌ νερό.

Γιατί αλκαλικό ΝΕΡΟ?

Αλλάξτε το νερό σας και θα αλλάξει η ζωή σας!

Τα 5 σημαντικότερα οφέλη του να πίνεις αλκαλικό νερό

Βελτιώστε την υγεία σας, φορτίστε το ανοσοποιητικό σας σύστημα, και καταπολεμήστε την διαδικασίας γήρανσης με πλούσιο σε αντιοξειδωτικά αλκαλικό νερό.

Οι τοξίνες είναι η νούμερο ένα αιτία της γήρανσης του πληθυσμού. Συχνά είναι αποτέλεσμα της κακής διατροφής, της ρύπανσης, και του άγχους. Οι τοξίνες συσσωρεύονται στο σώμα προκαλώντας καταστροφή των κυττάρων που οδηγεί σε πρόωρη γήρανση. Ο καλύτερος τρόπος να καταπολεμήσετε τις τοξίνες και να αποτοξινώσετε το σώμα σας είναι τα αντιοξειδωτικά. Και είναι τόσο εύκολο όσο το να πιεις πλούσιο σε αντιοξειδωτικά αλκαλικό νερό. Αλλάξτε το νερό σας και αλλάξετε τη ζωή σας! Εδώ είναι 5 μεγάλα οφέλη του να πίνεις αλκαλικό νερό:

1. Αποτοξινώνει

Αποτοξινώνει το σώμα σας αφαιρώντας τα προϊόντα των φυσιολογικών όξινων καταλοίπων που σωρεύονται καθημερινά, καθώς και αφαιρεί τις τοξίνες που συσσωρεύονται στο σώμα από το περιβάλλον, τα συνταγογραφούμενα φάρμακα, αφύσικες τροφές και από την «κανονική» διαδικασία της γήρανσης. Τα όξινα απόβλητα που συλλέγονται στο σώμα μπορεί να οδηγήσουν σε πιο σοβαρές καταστάσεις υγείας. Η καθημερινή πόση καθαρού αλκαλικού νερού μπορεί να εξουδετερώσει την οξύτητα ξεπλένοντας τα προϊόντα των όξινων απόβλητων από τα κύτταρα και τους ιστούς. (Για να συμβεί αυτό, χρειαζόμαστε ΚΑΘΑΡΟ νερό, άρα φιλτραρισμένο, όπως είπαμε και πιο πάνω, διότι αν ο κύριος αποτοξινωτής μας είανι βρώμικος, θα είναι σαν να ξεπλένουμε την μπουγάδα μας με απόνερα…)

Δείτε ακόμη: 10 τροφές για super αποτοξίνωση!

Κάνε αυτά τα βήματα για καθημερινή ΑΠΟΤΟΞΙΝΩΣΗ και δες το σώμα σου να αλλάζει!

Αποτοξίνωση από βαρέα μέταλλα, τοξίνες και chemtrails

2. Ενυδατώνει

Ενυδατώστε το σώμα σας: αυτό είναι βασικό για να διατηρήσετε ή να ανακτήσετε τη βέλτιστη υγεία. Κατά τη διάρκεια του ιονισμού, το φίλτρο του αλκαλικού νερού μετασχηματίχει το νερό σας σε μικρά συμπλέγματα που απορροφούνται πιο εύκολα σε κυτταρικό επίπεδο προκαλώντας "σούπερ ενυδάτωση" στο σώμα σας.

Δείτε ακόμη: Μήπως είστε Αφυδατωμένοι; Κοινά Νοσήματα και Συμπτώματα που οφείλονται στη Χρόνια Αφυδάτωση.

3. Οξυγονώνει/ Αντιοξειδωτικά

Το αλκαλικό νερό δρα ως αντιοξειδωτικό, σαρώνει και εξουδετερώνει τις επιβλαβείς ελεύθερες ρίζες. Επειδή το αλκαλικό νερό έχει τη δυνατότητα να απελευθερώνει ηλεκτρόνια, μπορεί να εξουδετερώσει αποτελεσματικά και να μπλοκάρει τη ζημιά που προκαλούν οι ελεύθερες ρίζες στο σώμα. Το Ιονισμένο αλκαλικό νερό αναζητά τις ελεύθερες ρίζες και τις μετατρέπει σε οξυγόνο που το σώμα μπορεί να χρησιμοποιήσει για την παραγωγή ενέργειας και την οξυγόνωση των ιστών. Ο καρκίνος και οι περισσότερες άλλες ασθένειες δεν μπορούν να επιβιώσουν σε ένα οξυγονωμένο, αλκαλικό περιβάλλον.

Δείτε: Τι είναι οι ελεύθερες ρίζες και τα αντιοξειδωτικά!

Και: Γιατί τα αντιοξειδωτικά είναι σύμμαχος της υγείας μας!

4. Αλκαλοποιεί το Ph του σώματος

Το Αλκαλικό νερό βοηθά στην ισορροπία του pH του σώματος, το οποίο τείνει να είναι όξινο, λόγω της διατροφής μας, υψηλή σε όξινα τρόφιμα, το άγχος και την έκθεση σε περιβαλλοντικές τοξίνες, όπως η αιθαλομίχλη. Αλκαλοποιεί το pH του σώματός σας από όξινο σε αλκαλικό pH, επειδή ο καρκίνος και πολλές άλλες ασθένειες δεν μπορούν να ζήσουν σε αλκαλικό περιβάλλον. Αλκαλική είναι η «φυσιολογική» κατάσταση των υγιών ατόμων.

Δείτε ακόμη: Αλκαλικές vs όξινες τροφές

Αλκαλική Διατροφή – Μέρος 1ο.

Αλκαλική Διατροφή – Μέρος 2ο.

5. Ενισχύει το ανοσοποιητικό σύστημα

Ενισχύει το ανοσοποιητικό σας σύστημα μεγιστοποιώντας την ικανότητα του σώματός σας να καταπολεμήσει τη νόσο και να θεραπεύσει τον εαυτό του.

Δείτε: Η ασθένεια ΔΕΝ προκαλείται από ιούς και βακτήρια,αλλά απο το εξασθενισμένο ανοσοποιητικό σύστημα!

Ανοσοποιητικό σύστημα…ας το θωρακίσουμε!

Δείτε ακόμη: Γιατί πρέπει να πίνουμε κάθε πρωί νερό με άδειο στομάχι!

Η χλωρίωση του νερού καταστρέφει την πρωτεΐνη των κυττάρων

Νερό – Δηλητήριο σε όλη την Ελλάδα.

ΤΑ ΜΥΣΤΙΚΑ ΤΟΥ ΝΕΡΟΥ ΚΑΙ Η ΔΡΑΣΙΣ ΤΟΥ ΣΤΟΝ ΆΝΘΡΩΠΟ!!